On 22 January 2024, MainStreet Partners, the London-based ESG partner of top-tier investors and distributors, announced Nordea 1- European Stars Equity Fund has won its 2024 “ESG Champions” award for Best ESG European Equity Fund.

The ESG Champions awards recognise a select number of funds and asset managers that have excelled within a universe of 7,700 strategies managed by over 360 asset managers. Awards were given across several broad categories spanning Equities, Fixed Income, Multi-Asset and Thematic investing.

Hilde Jenssen, Head of Fundamental Equities at Nordea Asset Management:

“We are honoured to be a recipient of this ESG Champions 2024 Award for Nordea 1 – European Stars Equity Fund. Capitalizing on our experience in ESG integration via the ESG STARS concept, the Fund aims to benefit from Europe’s many leading companies supporting the green transition and a strong Europe, thanks to our ESG enhanced and style agnostic bottom-up approach.”

Nordea 1 – European Stars Equity Fund taps into current trends around repowering the EU, relocation of supply chains and energy independence. Managers take a balanced approach to portfolio construction which aims to identify strong fundamentals and ESG cases within both the ‘Value’ and ‘Growth/Quality’ parts of the European market.

Neill Blanks, Research Director at MainStreet Partners:

“The Nordea 1 – European Stars Equity Fund has been awarded Best ESG European Equity Fund. This recognition is attributed to its comprehensive integration of ESG principles throughout the entire process, encompassing portfolio construction, active ownership, and extensive ESG reporting. Despite the strategy being classified under SFDR Article 8, the Fundamental Equities Team seeks to invest in companies that lead in ESG solutions within Europe employing Nordea’s STARS approach and a proprietary ESG score. This score evaluates Environmental, Social, and Governance KPIs while also considering alignment with Sustainable Development Goals.”

Mainstreet Partners ESG Champions commendation is only awarded if asset managers meet or excel the strict parameters set out by Mainstreet Partners experts. The methodology has evolved over 16 years and includes a holistic assessment of three core pillars, meaning firms’ ESG credentials are analysed not just on portfolio holdings but on the fund’s strategy and that of the asset management firm as a whole.

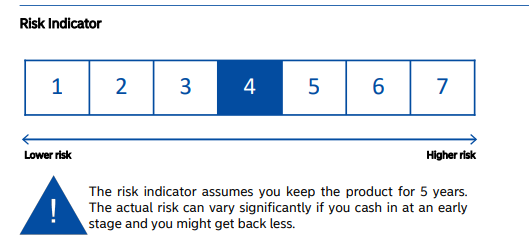

Be aware of currency risk. In some circumstances you will receive payments in a different currency, so the final return you will get depend on the exchange rate between the two currencies. This risk is not considered in the indicator shown above. For more information on risks the fund is exposed to, please refer to the section “Risk Descriptions” of the prospectus. Other risks materially relevant to the PRIIP not included in the summary risk indicator: Derivatives risk: Small movements in the value of an underlying asset can create large changes in the value of a derivative, making derivatives highly volatile in general, and exposing the fund to potential losses significantly greater than the cost of the derivative.