Cast your line for higher return potential:

dynamic allocation in high-quality bonds

Get active. Fish for smarter returns!

Today, as interest rates come down, investors with expiring cash deposits or low-risk investments face a pivotal choice: stay in low-return investments or embrace new opportunities with greater potential.

Conservative investors looking to generate extra returns should choose a more dynamic approach that actively allocates to different highly secure investment options.

A proven solution for challenging times

By combining premium fixed income securities, our expert team has designed a fund that seeks to consistently outperform cash rates, even under challenging conditions.1

Nordea 1 – European Covered Bond Opportunities Fund

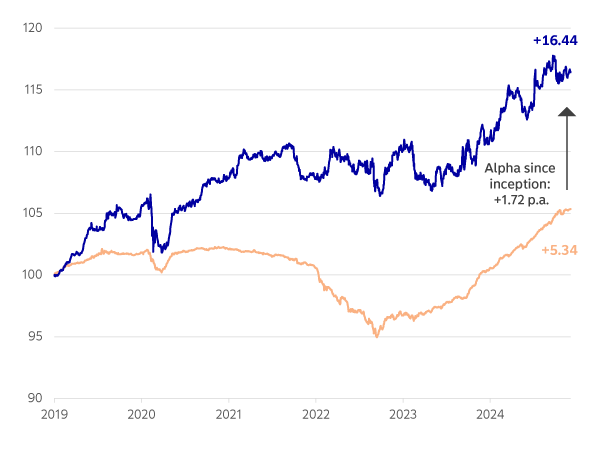

Since its launch in 2019, this fund has demonstrated that even in volatile environments, carefully managed high-quality bond allocations can generate steady and reliable returns.

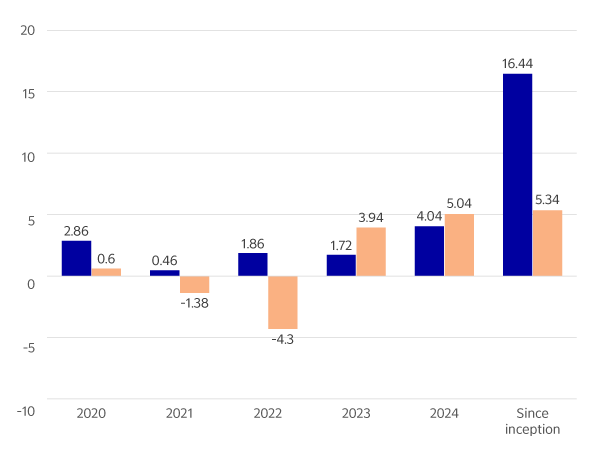

For example, in 2022, while bond markets suffered significant losses, it outperformed its benchmark2 by +6.16%, delivering a positive return of 1.86% (BP-EUR).

Nordea 1 - European Covered Bond Opportunities Fund (BP-EUR)

Making your cash work smarter

Rebased historical performances since inception

Discrete year performance since inception

| Fund | Benchmark |

Source: Nordea Investment Funds S.A. Period under consideration: 29/01/2019 – 31/12/2024. Performance calculated NAV to NAV (net of fees and Luxembourg taxes) in the currency of the respective share class, gross income and dividends reinvested, excluding initial and exit charges as per 31/12/2024. Initial and exit charges could affect the value of the performance. The performance represented is historical; past performance is not a reliable indicator of future results and investors may not recover the full amount invested. The value of your investment can go up and down, and you could lose some or all of your invested money. If the currency of the respective share class differs from the currency of the country where the investor resides the represented performance might vary due to currency fluctuations. With effect from 14/12/2020, the official reference index of the fund is Iboxx Euro Covered Interest Rate 1Y Duration Hedged. Prior to this date, the fund did not have an official reference index. The performance of the reference index before this date is provided for convenience purposes. This reference index is used for performance comparison purposes.

A high quality “rates”

investment universe

- Government bonds

- Investment-grade bonds issued by supranational entities (SSAs)3

- High quality covered bonds

Dynamic allocation

across the rates spectrum1

- Active and dynamic allocation of high credit quality bonds to generate potencial return

- Limiting duration to reduce sensitivity to macroeconomic factors like interest rate changes or political and economic developments

- Focusing on bond-specific factors offering opportunities to generate additional returns

Stable team with

a proven track record

- Experienced team with over 15 years of collaboration

- Managing over EUR 40 billion in the rates universe4

- Award-winning expertise in fixed income markets

- Deep understanding of bond-specific factors and market opportunities

For those looking for oportunities seeking even greater returns within high quality bonds, we offer the same concept with a slightly higher risk / return profile: Nordea 1 – Global Rates Opportunity Fund.

Turn today’s liquidity into tomorrow’s growth with our expertly crafted solutions—designed to thrive in various market environments.

Two innovative funds tailored to your risk / return appetite

Nordea 1 - European Covered Bond

Opportunities Fund

LU1915690595 (BP – EUR) /

LU1915690835 (BI – EUR)

Duration: low

Risk: 2 (low)5

Expected return: conservative

Nordea 1 - Global Rates

Opportunity Fund

LU2643719961 (BP – EUR) /

LU2643719888 (BI – EUR)

Duration: low

Risk: 3 (medium-low)5

Expected return: moderate

Benefit from Nordea’s expertise in dynamic allocation within the global rates sector. Reel in the return potential.

1) There can be no warranty that an investment objective, targeted returns and results of an investment structure is achieved. The value of your investment can go up and down, and you could lose some or all of your invested money. 2) Iboxx Euro Covered Interest Rate 1Y Duration Hedged. 3) Sovereign, supranational, and agency bonds (SSAs) are bonds issued by institutions like the World Bank or the European Investment Bank and other institutions whose activities include supporting social initiatives. 4) As of 31.12.2024. 5) Referring to KID SRI Risk & Reward Profile assuming investors stay invested in Nordea 1 – European Covered Bond Opportunities Fund investors for 3 years, and investors stay invested in Nordea 1 – Global Rates Opportunities Fund for 5 years.

Covered bond risk: Covered bonds are bonds usually issued by financial institutions, backed by a pool of assets that secure or “cover” the bond if the issuer becomes insolvent. With covered bonds the assets being used as collateral remain on the issuer’s balance sheet, giving bondholders additional recourse against the issuer in case of default. In addition to carrying credit, default and interest rate risks, covered bonds could face the risk that the collateral set aside to secure bond principal could decline in value.

For more information on risks the funds are exposed to, please refer to the section “Risk Descriptions” of the prospectus.