Although pension funds keep costs low with purely passive investment solutions, it is hardly possible to achieve return and sustainability targets.

The investment year 2023 was above average for Swiss pension funds in a long-term comparison. According to the Swisscanto Pension Fund Study 2024, they achieved an average return of 5.1%, but the ten-year average is 3.5%.1 Accordingly, pension funds are under constant pressure to generate the highest possible returns in order to enable their policyholders to continue their adequate standard of living after retirement.

At the same time, administrative costs should be as low as possible, as these in turn reduce performance and thus pensions as fixed costs. In order to generate the highest possible returns with low administrative costs, Swiss pension funds are increasingly relying on passive investment solutions. But even these incur fees that should not be underestimated. Taking costs into account, passive funds systematically underperform the benchmark.

Risk premia make portfolio robust

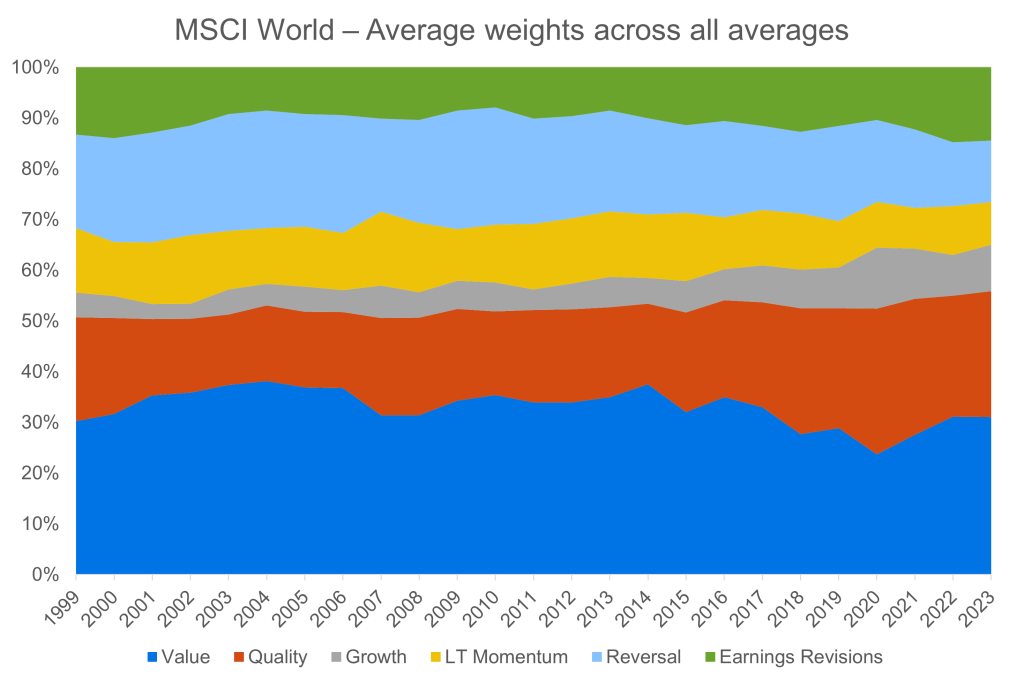

Enhanced indexing solutions can be used to achieve optimisation in this context. The investment universe is determined by selecting a benchmark before defining different market segments within that investment universe. This can be, for example, biotechnology in the North American pharmaceutical market. With the help of strategic risk premia such as value and quality as well as shorter-term risk premia such as growth, long-term momentum, earnings momentum and trend reversal, a ranking of companies with favourable return potential is then created within the selected segment. Companies that do not perform well in terms of risk premiums are excluded from the portfolio.

It is important that the risk premiums are hardly correlated with each other in order to make the portfolio as robust as possible. To ensure this resilience over the years, the weighting of risk premiums is regularly reviewed and, if necessary, adjusted. If it turns out that value is too important, the risk premium is reduced in favor of quality, for example. The extent to which these adjustments will be depends very much on the sector and segment: In the largely stable equipment and services segment of the North American healthcare market, the weightings of risk premiums do not usually have to be changed significantly. In the biotech segment, on the other hand, which is characterised by a high frequency of innovation and thus greater volatility, more drastic changes to these weightings of risk premiums may be necessary.

Compared to traditional passive investment solutions, pension funds can thus generate a robust excess return, thus covering the costs of management and laying the foundation for stable pension funds. At the same time, the costs of such a solution are very low and the tracking error remains within the scope of an ETF.

Tailor-made decarbonisation path

Enhanced indexing solutions also have a decisive advantage over traditional passive vehicles in terms of regulatory requirements regarding the consideration of sustainability criteria: the portfolio can be modelled in such a way that it achieves the pension fund’s specific CO 2 reduction target. Such a high degree of individualisation cannot be achieved with a purely passive fund.

Ultimately, pension funds may lack the necessary expertise to achieve the sustainability goals they have set on the portfolio side. Asset managers who offer enhanced indexing investment solutions can support pension providers in terms of sustainability with individual solutions.